Social Impact

Financial Inclusion

Financial inclusion is one of our priorities, and we aim to provide accessible financial services to everyone and increase financial literacy among the communities where we operate through:

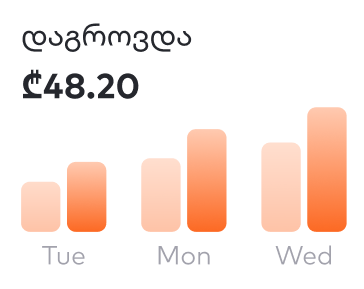

Increasing the use of digital financial products and services

Building financial literacy among young people

Building capabilities of local businesses with relevant tools and information

Increasing the use of digital financial products and services

We use the power of our outreach to increase financial literacy through digital content as well as personal interactions with our customers, and use the power of technology and product innovation to provide accessible and affordable financial services to everyone:

Customers can access our mobile app’s full functionalities without Wi-Fi or mobile data

Digital onboarding in our mobile app and internet bank

Tutorials and instructions for new digital products are available on our website

Free or low-cost current accounts and debit cards

Free product bundles for school and university students and a separate tailored mobile app for school students – sCoolApp

Lower fees on payments acceptance solutions for smaller merchants

A wide network of ATM and BOG pay self-service terminals across Georgia

A Web version of BOG Pay terminals – bogpay.ge

Building capabilities of local businesses with relevant tools and information

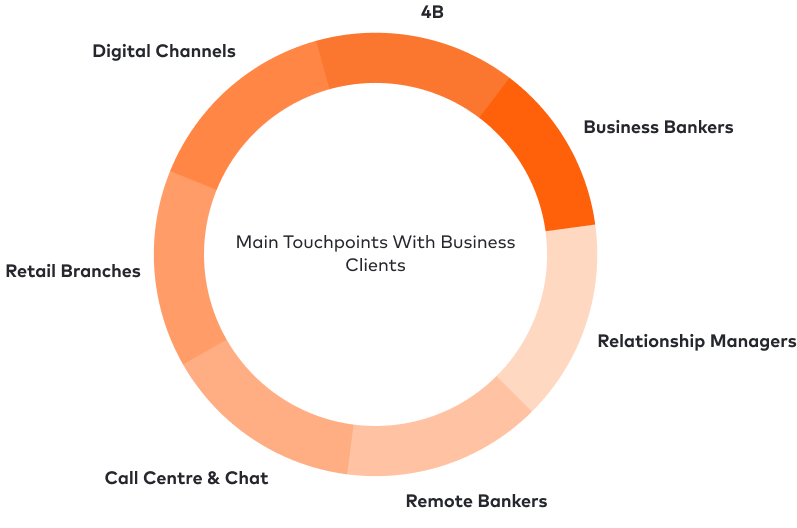

The most effective way to support our business clients – SMEs and bigger corporates – is by pairing financial support with value-added services that drive success.

How we ensure financial inclusion of our businesses

Bank of Georgia will regularly assess climate-related physical and transition risks across its lending portfolio. In 2022 we started collecting relevant data from borrowers to understand their

Bank of Georgia will regularly assess climate-related physical and transition risks across its lending portfolio. In 2022 we started collecting relevant data from borrowers to understand their

Bank of Georgia will regularly assess climate-related physical and transition risks across its lending portfolio. In 2022 we started collecting relevant data from borrowers to understand their

Bank of Georgia will regularly assess climate-related physical and transition risks across its lending portfolio. In 2022 we started collecting relevant data from borrowers to understand their

We Have Various Services To Provide Our Clients A Personal And Professional Development

One of the biggest obstacles MSMEs face when they need access to finance is a lack of proper accounting.

We run an Accounting Development Programme to help such businesses implement proper accounting practices – enabling the Bank to access relevant financial information quickly for faster, more fficient decision-making.

260

1.3 %

300

40 %

One of the biggest obstacles MSMEs face when they need access to finance is a lack of proper accounting.

We run an Accounting Development Programme to help such businesses implement proper accounting practices – enabling the Bank to access relevant financial information quickly for faster, more efficient decision-making. 2

250

1.2 %